Stamp Duty is payable on the actual price or net asset value of the shares whichever is higher. As can be seen the other charges are not directly related to.

Ws Genesis E Stamping Services

During the Budget 2021 tabling Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz stated that first-time buyers will be given stamp duty exemptions on the memorandum of transfer documents MOT and loan agreements.

. Fast-paced development of the property as working capital is majorly required for meeting the construction needs. Our Story Get to know us better. 500- whichever is lower.

Competent consideration for the landlord. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. Quit Rent is calculated by multiplying the size of an owned property in sq ft or sq meters by a specified rental rate.

So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government. What is stamp duty. LHDN RPGT amendment under Budget 2022.

How to calculate RPGT and what kind of impact does. B sends an email from Singapore accepting As offer. Do you have to pay stamp duty on rental agreements.

Partial avoidance of stamp duty. This website belongs to GTRZ. Stamp Duty Land Tax SDLT is a tax paid by the buyer of a UK residential property when the purchase price exceeds 125000.

The stamp duty rate ranges from 2 to 12 of the purchase price depending upon the value of the property bought the purchase date and whether you are a multiple home owner. When do you have to pay stamp duty. Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary.

The electronic document is treated as executed in Singapore and at the time B sends the second email. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement. Legal Fees Payable.

The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. Stamp duty is 1 of the total rent plus deposit paid annually or Rs. Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it.

For example if the specified rate is RM0. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. Generally on-the-road price includes on top of the cost of the motorcycle other charges such as vehicle registration fee road tax insurance premium legal stamp duty and handling fees for financing etc.

According to Amit Modi Director ABA Corp A Joint Development Agreement JDA is beneficial for both the owner as well as the developer. Quit rent is an annual land tax imposed on private properties in Malaysia while parcel rent is its equivalent for stratified properties both are payable to the state authority. Stamp Duty Calculator.

The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status. Equity release calculator Stamp duty calculator Credit cards 0 Balance transfer cards Credit builder cards 0 New purchase Credit cards for bad credit Cashback cards Rewards cards Use abroad cards Money transfer cards Loans Personal loans Loan calculator Debt consolidation loans Bad credit loans Car finance Car finance calculator Homeowner loans. Kelana Square 17 Jalan SS726 47301 Petaling Jaya Selangor Darul Ehsan Malaysia.

Tenancy Calculator Monthly Rental Fee. As per the Budget 2022 announcement individuals who are Malaysian citizens and permanent residents will benefit from the removal of the Real Property Gains Tax RPGT on the disposal of any residential property in the sixth year of ownership and beyond. A sends an email from Malaysia offering to sell property to B.

Buyers will be sent this in an email sometime. ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra. Stamp duty is the governments charge levied on different property transactions.

Calculate the stamp duty you may have to pay on your property using our tool. Budget 2022 Stamp Duty Exemption For First-Time Buyers Great news.

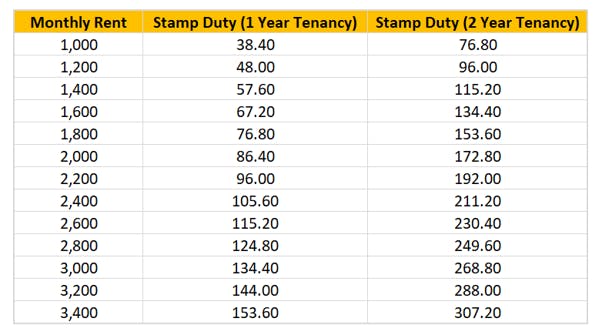

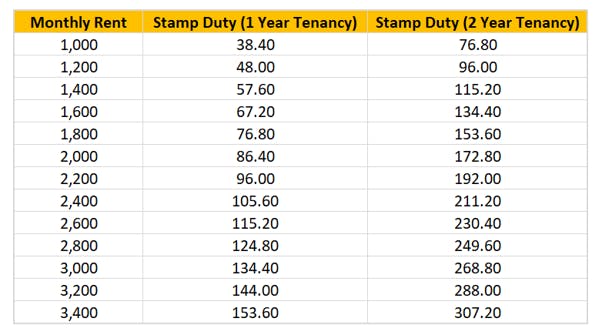

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Ec Realty

Tenancy Agreement Stamp Duty Calculator Malaysia

Ws Genesis E Stamping Services

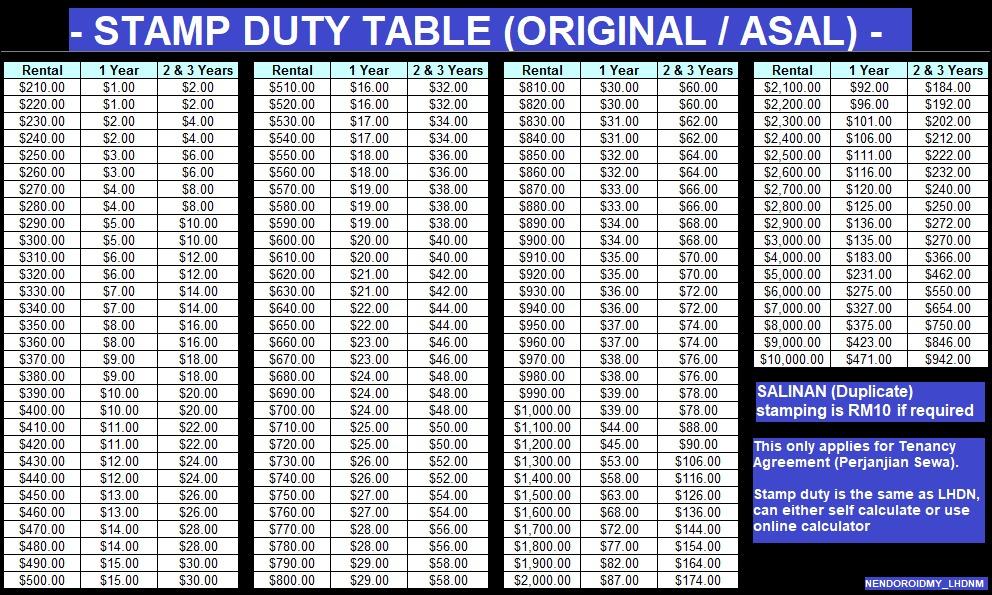

Rental Agreement Stamp Duty Malaysia Speedhome

Lhdn Tenancy Agreement Stamping Service Lhdn Online Stamping Penyeteman Perjanjian Sewa Perjanjian Sekuriti Perjanjian Am 合同 合约 印花税 Verified Jobs Full Time Customer Service On Carousell

Tenancy Agreement Stamp Duty Calculator Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Sme Corporation Malaysia Stamp Duty Rate

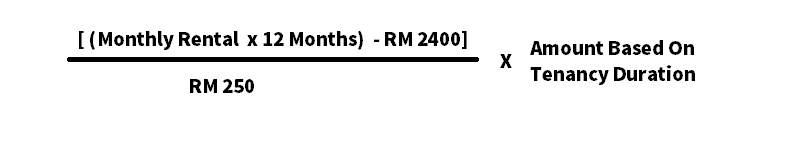

How To Calculate Tenancy Agreement Stamping Fee

Sheldon Property Malaysia Property Stamp Duty Calculation Facebook By Sheldon Property Don T Know How To Count Property Stamp Duty Here Is It

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Everything You Need To Know Before Signing A Tenancy Agreement Instahome

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia

What Is A Trust Deed And Why Is It Important

Pin On Malaysia Property Info 地产资讯

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved